Let's Crank Up Your Lead Flow

We have created an ALL-IN-ONE solution that has

everything you need to set up your system & run a successful business!

The Software That Makes Getting Clients SIMPLE.

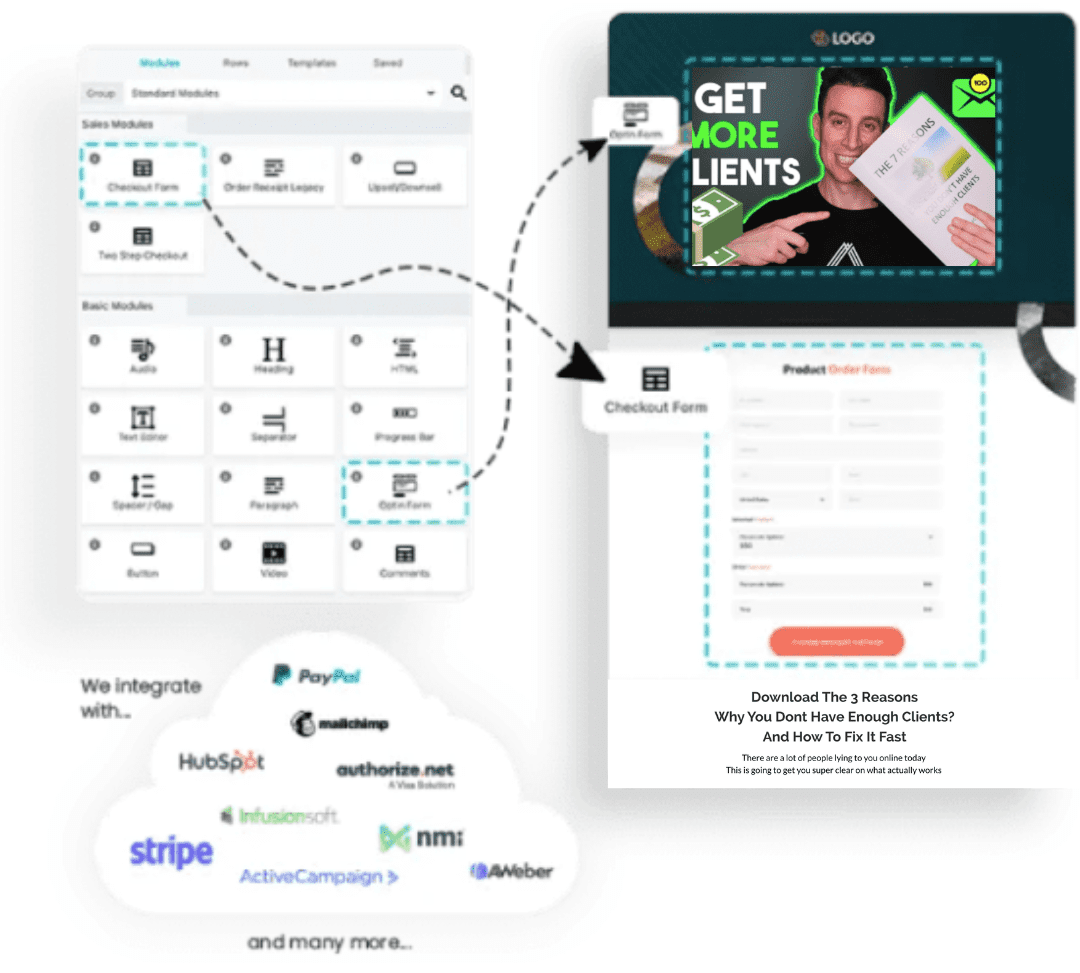

Blazing Fast Sales Funnels

Our powerful sales funnel infrastructure gives you FASTEST in-class page load speeds, which translates directly to higher conversions

Unlimited funnels with one-click order bumps, upsells, downsells, and fast-loading for maximum conversion from paid or organic traffic. Average page load time is under 2 seconds!

Integrates easily with Stripe, Paypal, NMI, Authorize.net, Infusionsoft, Active Campaign, Hubspot, Mailchimp, Aweber and many more

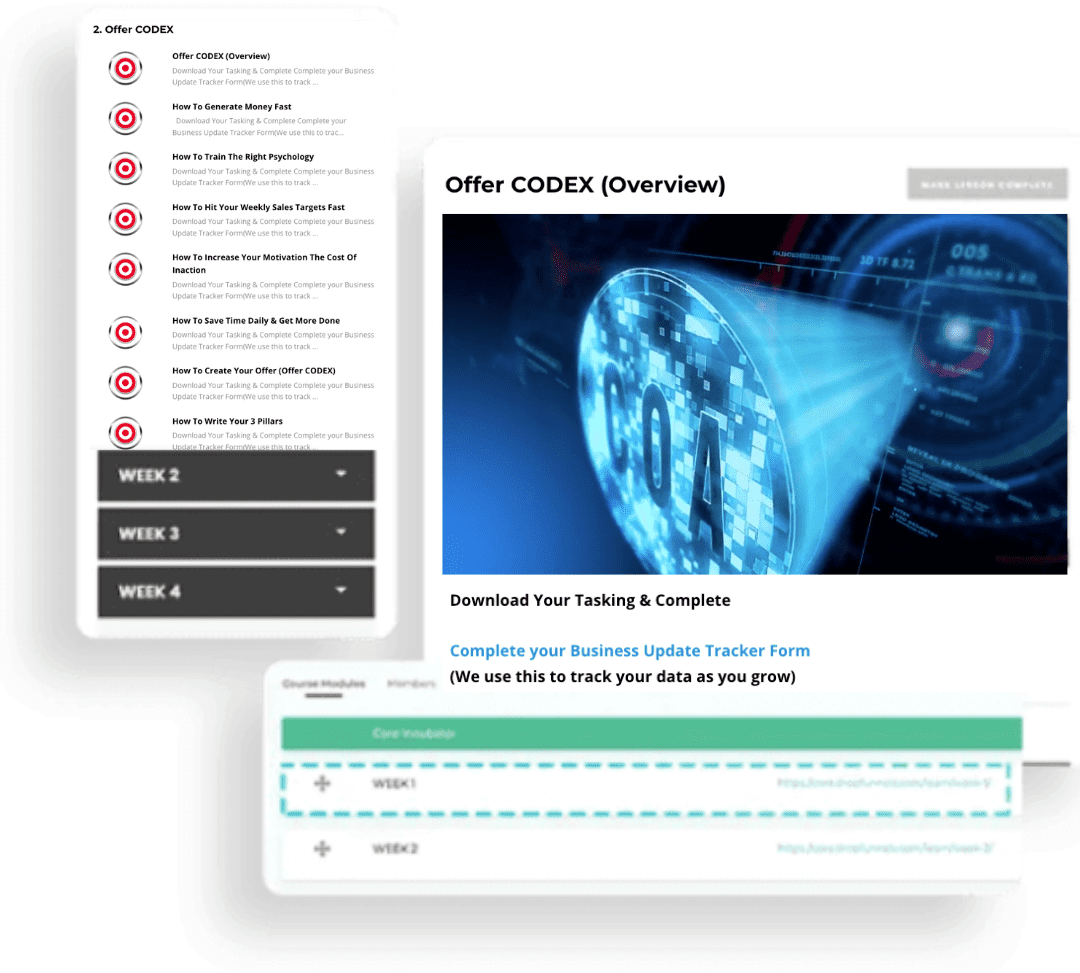

Create Powerful Signature Programs

Get unlimited courses, modules and lessons. Drip or Block content, and engage with comments from your students.

Build your dashboard, login pages, first-time welcome pages, and restricted access pages with pixel perfect design.

When users checkout on your sales funnel, they get instant access to your course, based on what they purchase

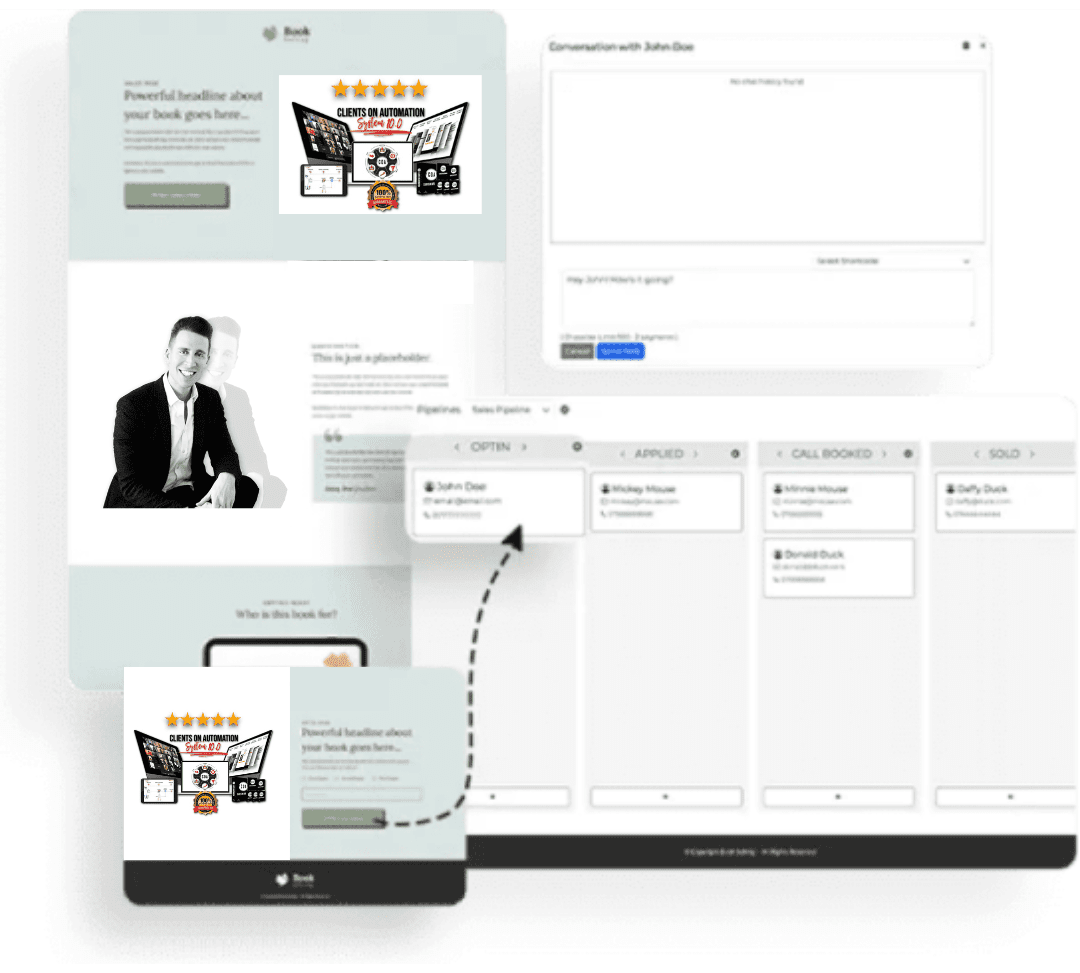

Automatic Email Sales Pipelines

Manage your leadflow and directly chat with your leads via text or email, all in one place.

Create dynamic sequences to automatically contact and move your leads through your sales process.

Easily import our COA Follow-Up Email Automation to stremline your funnel

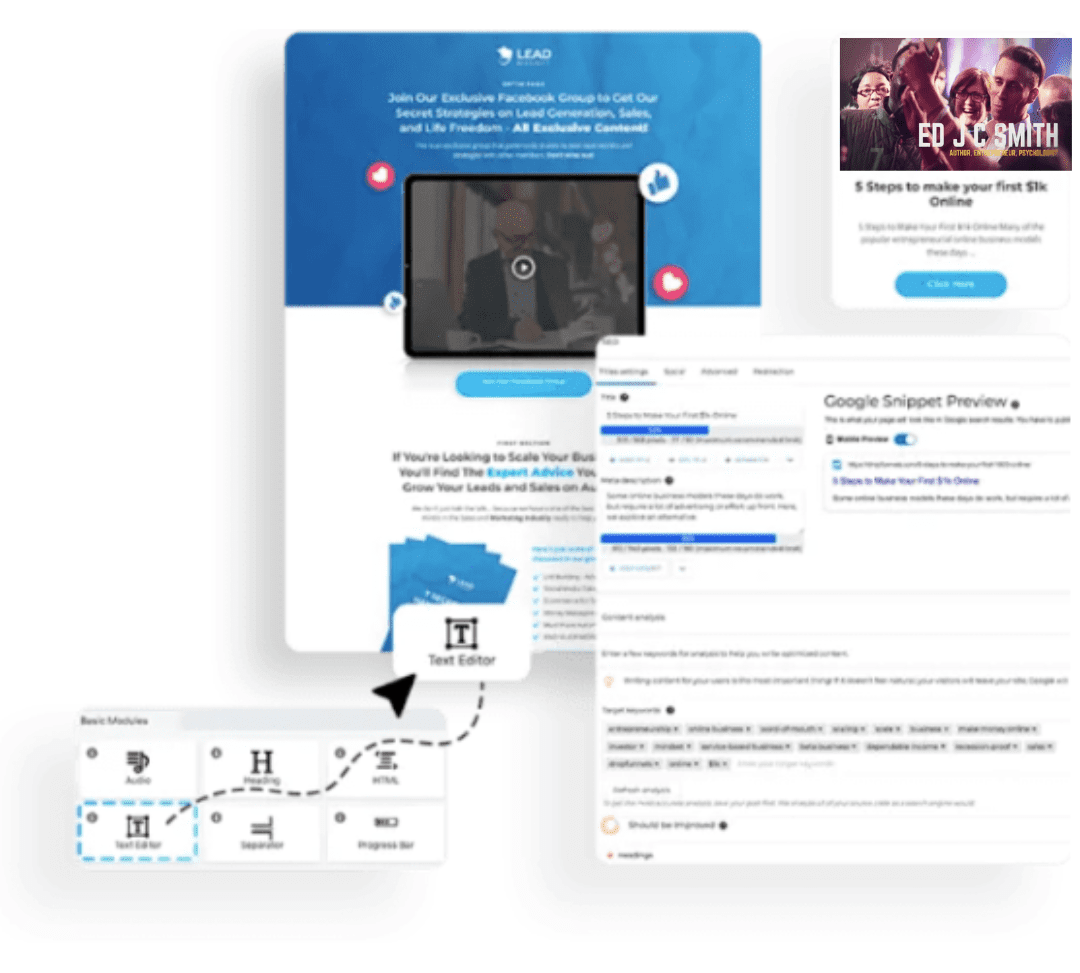

Get Ranked with Authority Websites

Clients On Automation Software is built on the #1 ranking tech infrastructure favored by search engines.

Grow your rank and reputation with your own custom website and easy-to-use blog

Since Clients On Automation Software is hosted for you on WordPress (which Google LOVES), you rank higher and faster than on any other platform, period

and Much Much More!

FAQs

Still Have Questions?

The Software That Makes It Easy To Get Clients

Copyright © Clients On Automation Ltd. All Rights Reserved